axisfirst Latest News

We Are Exhibiting At Business Festival Southwest 2026

Westpoint Arena in Exeter is the location for one of the biggest and best business 2 business tradeshows and networking events in the Southwest of England and axisfirst will be there taking part. On Wednesday 1st April you have the opportunity to ...

Using QR Codes with axis vMerchant Express

Have you ever wanted to use QR Codes in your marketing or product information to direct people to specific pages on your website? This is really easy to do and we have created an article explaining how to do it. The good news is that you ...

Seasonal Opening Hours 2025

We would like to take this opportunity to wish all of our customers a very Merry Christmas and a Prosperous New Year. Our Opening Hours for the holiday period are as follows: December ...

Cyber Security and Resilience Bill

The UK government has launched a new Cyber Security and Resilence Bill designed to help strengthen the defences for essential public services. This will include ...

Cyber Security Awareness Month 2025

October is global cyber security awareness month. The key focus in the industry in 2025 is the vital role that emotional awareness and human behaviour plays in ...

New axis diplomat video tutorials

We are pleased to announce the launch of a continuing series of video tutorials on using axis diplomat. These videos, which will be released gradually over ...

Come Join Us In Plymouth!

Axis First will be exhibiting at the Plymouth Life Centre on Wednesday 15th October 2025 for this year's Devon Business Show. The event hopes to build on ...

Meet Our Team In Cornwall This October!

We are back in Wadebridge on Thursday 9th October exhibiting at the Cornwall Business Show for our 4th year. This year's event is tipped to be bigger and ...

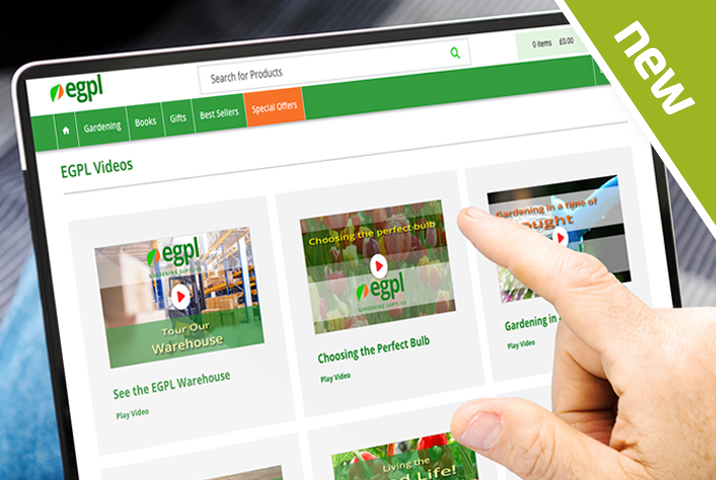

Create Video Playlist Pages with axis vMerchant

It is now possible to create one or more web pages on your axis vMerchant Express website containing playlists of videos hosted on YouTube. All of the ...

World Password Day

Each year on the 1st May is World Password Day. It is marked to remind businesses and individuals the importance of good password management and to educate and ...

UPDATE axis diplomat and the Windsor Framework

The Windsor Framework is a trade agreement designed to address the challenges of post-Brexit customs and regulatory arrangements between Great Britain and ...

Add Images to Main Menu

Our eCommerce solution, axis vMerchant Express, has been extended to provide a new Header Menu Style to allow you to add images to your site's Main ...

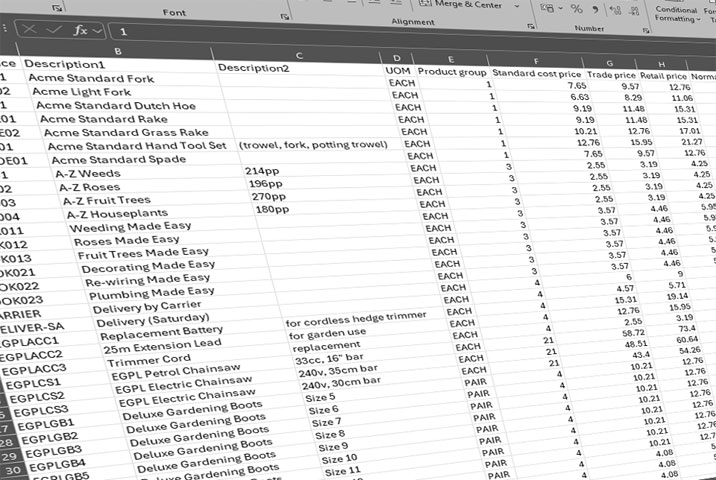

Updated Stock Import function for axis diplomat

We are pleased to announce the release of a significant update to the function Import Stock Details from CSV. This function is used to update existing stock ...

axis payroll 2024/2025 Year End Updates

We are pleased to announce the availability of important software updates for axis payroll. Software updates in readiness for the 2024/2025 payroll tax ...

Payrolling Benefits in Kind (BiKs)

In January 2024 the government announced that from 6 April 2026 employers will be required to report and pay Income Tax and Class 1A NICs on most ...

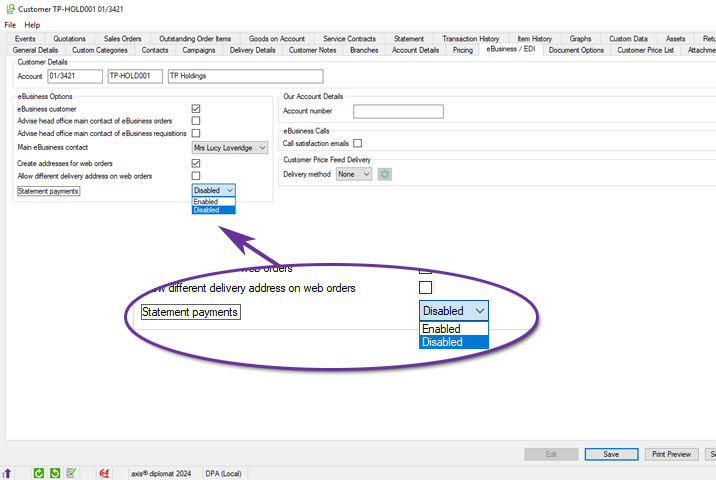

Restrict Online Statement Payments

For those using their axis vMerchant Express website to allow their customers to settle outstanding balances (for invoices raised 'on account') via card ...

axis diplomat and the Windsor Framework

The Windsor Framework is a trade agreement designed to address the challenges of post-Brexit customs and regulatory arrangements between Great Britain and ...

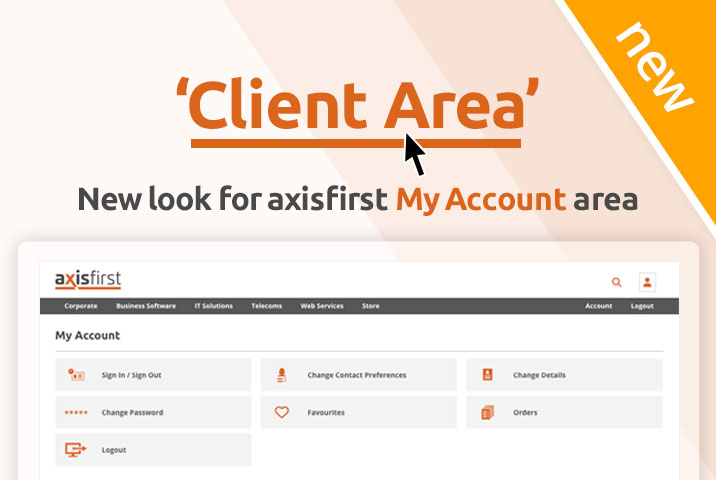

New Client Area Coming Soon...

We are pleased to announce that, shortly, we will be launching an all-new Client Area for our website. You can preview this site for yourself now and the full ...

Seasonal Opening Hours 2024

We would like to take this opportunity to wish all of our customers a very Merry Christmas and a Prosperous New Year. Our Opening Hours for the holiday ...

axis diplomat 2024 has now been released

We are pleased to announce the launch of axis diplomat 2024. This release is the culmination of the past two years’ development work since the launch ...