axis diplomat and Making Tax Digital for VAT

- Making Tax Digital for VAT Frequently Asked Questions

- Watch videos on using axis diplomat with Making Tax Digital for VAT

All versions of axis diplomat from axis diplomat 2016 and above have been updated to provide support for VAT Returns via Making Tax Digital ("MTD").

This guide provides an overview of the enhancements for MTD and the general method of operation.

First Steps

Registration

Before you can submit your VAT Returns using MTD, you must first register. You can register ahead of time so it is a good idea to start this process as soon as possible.

HMRC have produced documentation explaining this process:

Download a Software Update

The enhancements described below are now available.

If you are an axis diplomat 2016 or axis diplomat 2018 user, please ensure that you download and install a software update as soon as is convenient.

Software Enhancements

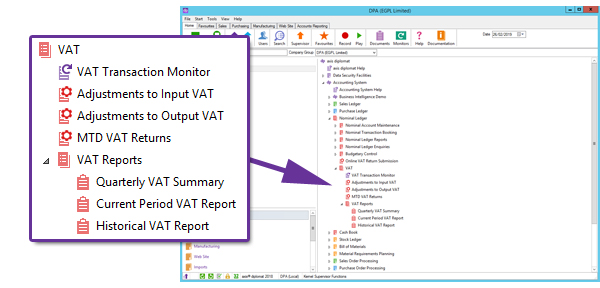

New VAT Menu

All VAT-related functions have been moved to a separate menu within the Nominal Ledger for added convenience.

New Adjustment Functions

Two new functions have been added to the system - "Adjustments to Input VAT" and "Adjustments to Output VAT". These provide the facilities to enter adjustments that would previously have been carried out prior to making a VAT Return.

By using these functions, any VAT adjustments that are required are digitally recorded within the same system that you are using for your VAT Return, thereby meeting the obligations under Making Tax Digital for digital record keeping.

You are able to define a number of VAT Adjustment Types to simplify the task of making regular adjustments via a new Supervisor Function.

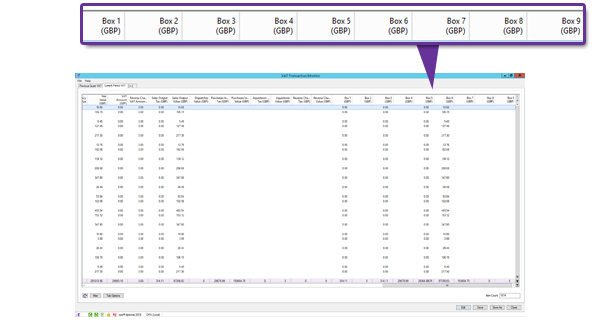

New VAT Transaction Monitor

A new monitor allows you to view the VAT figures that will be submitted as your VAT Return. This monitor can, in general, replace the use of the "Current Period VAT Report" and "Quaterly VAT Summary", although these reports have been retained for backwards compatibility.

The monitor includes separate columns for each of the nine boxes from the VAT Return:

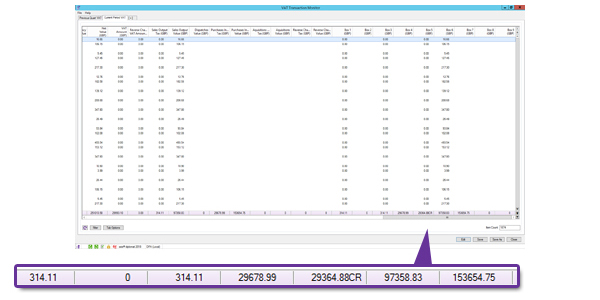

These columns are totalled and so provide an instant view of the figures that would be included on the VAT Return:

This is also available as a Monitor Tab that can be added to custom monitors.

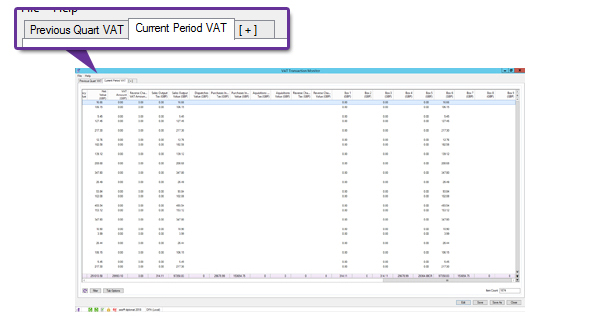

As with any axis diplomat Monitor, you can create your own additional tabs, pre-filtered. You can, for example, modify the monitor to include separate tabs for the Previous Quarter and the Current Period:

New VAT Return Submission

A new function, "MTD VAT Returns" has been added to submit your VAT Return using the new regime.

The first time that this function is run, you will be taken to the HMRC website to authenticate axis diplomat for use with Making Tax Digital.

HMRC will retain this authentication for 18 months - when the authentication expires, axis diplomat will automatically take you back to the HMRC website to re-authorise your software at the next submission. This means that there is no need to remember to periodically re-authorise the software.

The existing "Online VAT Return Submission" function will remain in place until all users have transitioned to MTD.

Method of Operation

In order to meet the requirements of MTD for digital record keeping, the figures for your VAT Return must come directly from your axis diplomat system and so any adjustments required must be made within this system.

Prior to completing a period, use the VAT Transaction Monitor to ensure that your figures are correct - if not, make any adjustments using the "Adjustments to Input VAT" and "Adjustments to Output VAT" functions before re-checking with the VAT Transaction Monitor.

When you are ready to submit your VAT Return, simply use the "MTD VAT Returns" function.

Demonstration Videos

We have produced a series of five short demonstration videos to show you the process of managing your VAT Returns using Making Tax Digital for VAT.