Last Updated: 29th December 2020

The trade deal that the UK has reached with the European Union does not change the requirement for axis diplomat systems to apply new VAT rules from 1st January 2021 as the UK is still leaving the EU VAT regime.

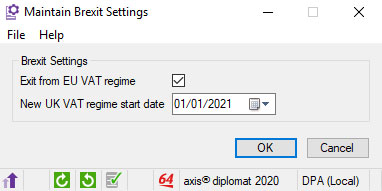

To ensure that UK VAT accounting is correctly recorded in axis diplomat, users of axis diplomat 2016 and above must ensure that their axis diplomat software is dated on or after 11th December 2020 and that ‘Maintain Brexit Settings’ is configured as follows:

The information contained with the axis diplomat and Brexit White Paper is still applicable following the UK and EU trade deal.

Those with an axis vMerchant website should also visit https://www.axisfirst.co.uk/web/brexit/ for information on how their website may be affected by Brexit.

For further information, visit https://www.gov.uk/transition »

This is, of course, a constantly evolving and changing subject so please remember to keep alert to the latest Government advice and the information that we will publish from time to time via our website.

Revision History

29th December

This page has been updated to indicate that software updates are still required despite the conclusion of a trade agreement due to VAT changes.

23rd December

The axis diplomat and Brexit White Paper has been updated with a new section providing information for non-UK axis diplomat systems and data sets. Please see section 1.14.

18th December

The axis diplomat and Brexit White Paper has been updated with information on modifications to Purchase Invoice and Credit Note booking functions.

7th December

The axis diplomat and Brexit White Paper has been substantially revised to reflect the latest Government information relating to a possible 'no deal' Brexit.

17th October

axis diplomat updates from today now include Brexit software enhancements.

Many of these enhancements are relevant to anyone trading internationally, irrespective of the outcome of Brexit. This includes, for example, EORI and Customs Invoices.

The functionality specifically relating to a "No Deal" Brexit is only activated once enabled by a user setting.

This means that the software is perfectly safe to use if there is a Brexit deal agreed or, indeed, if Brexit is delayed.

7th October 2019

The Brexit White Paper has been updated, not only to reflect further guidance from the Government, but also to include information on planned software enhancements.

These enhancements are being made to axis diplomat to allow operation in the event of a "No Deal" Brexit.

5th March 2019

HMRC have produced two videos explaining the processes for importing goods from, and exporting goods to, the EU in the event of a "no deal" Brexit:

Note: These videos have been subsequently withdrawn by HMRC.

28th February 2019

HMRC have today issued a press release highlighting steps that business owners need to take to continue to trade with the EU if the UK leaves without a deal:

We strongly recommend that you subscribe to our newsletters or follow us on Twitter to find out when further information is published.

4th January 2019

Our White Paper offering guidance to axis diplomat users in the event of a "no deal" Brexit has been updated to include information on EORI and to provide additional links to HMRC and Government Resources.