axis payroll - Latest Developments

The March 2017 axis payroll update incorporates a number of new developments.

Payrolling Benefits in Kind

In April 2016, the government introduced a voluntary framework to allow you to payroll most Benefits in Kind (BiKs).

One of the biggest benefits of payrolling in line with the framework is that you no longer need to submit P11Ds for payrolled BiKs.

axis payroll supports a ?Benefit in Kind? pay component which will be included in taxable pay but excluded from amount paid.

Further information on payrolling on BiK?s is available at https://www.gov.uk/guidance/paying-your-employees-expenses-and-benefits-through-your-payroll

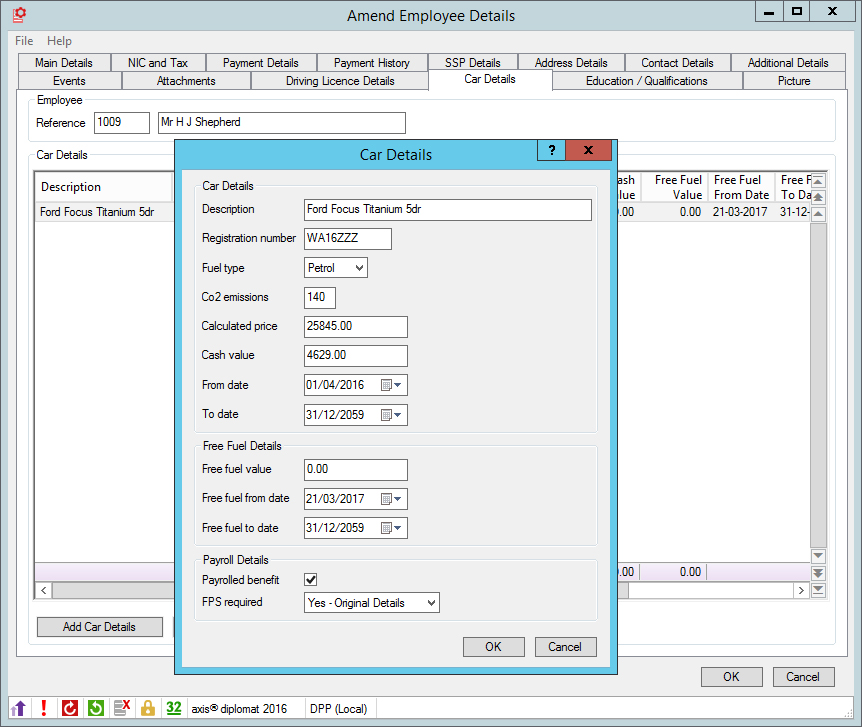

Recording Employee Car Details

If you are registered for payrolling Benefits in Kind (BiKs), from 6th April 2017 you will have the option to report car information for the tax year 2017/2018. For tax year 2018/2019 this will become a requirement for those employers payrolling BiKs.

axis payroll has been extended to allow recording of employee car details on the employee record and optionally submit this information in FPS submissions.

Apprenticeship Levy

From 6th April 2017, the Government is introducing an Apprenticeship Levy to help to fund and grow the apprenticeship programme.

The levy applies to all employers operating in the UK and is charged at 0.5% of an employer's annual pay bill. However, an annual levy allowance of ?15,000 is available to each employer to offset their liability. As a result, only employers with an annual pay bill of over ?3 million will be required to report and pay the apprenticeship levy.

axis payroll has been updated to support reporting requirements for the levy.

The axis payroll User Guide Supplement March 2017 contains more information on these developments as well as details on other changes that may affect your payroll.