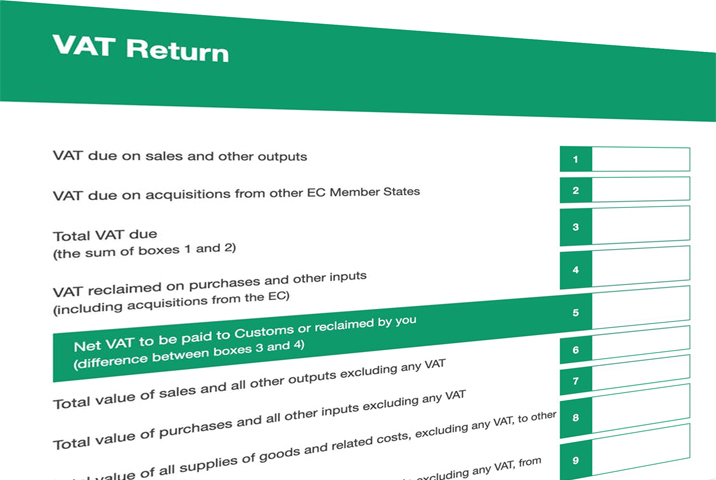

VAT Payment Deferral Scheme

On the 20th March, the Chancellor announced a VAT payments deferral scheme to help businesses with their cashflow during the COVID-19 pandemic.

All businesses with a UK VAT registration have the option to defer VAT payments due between 20th March 2020 and 30th June 2020.

Businesses have until 31st March 2021 to pay any VAT deferred as a result of this deferral.

Businesses do not need to inform HMRC if they wish to defer payment. They can opt in to the deferral simply by not making VAT payments due in this period.

Businesses can continue to make payments as normal during the deferral period and HMRC will also continue to pay repayment claims as normal.

Businesses must continue to submit VAT returns as normal.

Discover more: https://www.gov.uk/guidance/deferral-of-vat-payments-due-to-coronavirus-covid-19