axis payroll User Guide Supplement March 2020 |

|

1. What's New? |

|

1.1 Parental Bereavement Leave and Pay |

|

|

With effect from 6 April 2020, the UK government have introduced a new entitlement to Parental Bereavement Leave and Pay. This will provide parents who lose a child or suffer a stillbirth with a right to take two weeks off work. axis payroll has been updated to allow recording of Parental Bereavement Leave and to process Satutory Parental Bereavement Pay (SPBP). For further information, see Employer Bulletin February 2020 |

|

1.2 Employment Allowance |

|

|

The Employment Allowance for eligible employers increases to £4,000 per annum for 2020/2021. Due to changes in eligibility checking for this, a fresh claim is required for this with further information regarding your business sector. If you are eligible to claim Employment Allowance, you will need to ensure that you have flagged you payroll system accordingly and that you submit an Employer Payment Submission in the new tax year. Further information on processing this in axis payroll is provided later in this guide. Further details regarding the changes to Employment Allowance are available at https://www.gov.uk/guidance/changes-to-employment-allowance

|

|

1.3 Changes to Payrolling Benefits in Kind |

|

|

From April 2016 the government introduced a voluntary framework to allow you to payroll most Benefits in Kind (BiKs). If you want to payroll your BiKs for the tax year beginning 6 April 2020, you must have registered using the online Payrolling Benefits in Kind (PBIK) service. One of the biggest benefits of payrolling in line with the framework is that you do not need to submit P11Ds for payrolled BiKs. axis payroll supports a “Benefit in Kind” pay component which will be included in taxable pay but excluded from amount paid. axis payroll also allows for the recording of employee car details on the employee record and submitting this information in FPS submissions. From 6th April 2020, changes have been made to payrolling Company Car Benefits. If you are payrolling company car benefits, you will need to update the current car details for each employee to provide the 'Date first registered'. If the vehicle fuel type is Hybrid, you will also need to complete the 'Zero emissions mileage value'. These changes need to be made before your first payroll run of the new year. Further information on payrolling on BiK’s is available at https://www.gov.uk/guidance/paying-your-employees-expenses-and-benefits-through-your-payroll |

|

1.4 P60 Print |

|

|

Employers continue to be required to supply all employees with a P60 if they are still in your employment on 5th April 2020. The axis payroll March 2020 Legislation Update includes a new stationery option in 'P60 Print' of P60 pdf. This allows P60s to be printed onto plain A4 paper, avoiding the need to order P60 stationery from HMRC. Additionally, for axis payroll systems with the People HR interface feature, P60's can be delivered to your employees via their People HR account. These are password protected and an additional password protected copy is stored in the attachments tab of the employee record in axis payroll. |

|

1.5 Off-Payroll Workers |

|

|

Changes to off-payroll working rules come into effect from 6th April 2020. Details of these can be found at https://www.gov.uk/guidance/april-2020-changes-to-off-payroll-working-for-clients and within the Employer Bulletin (February 2020) Should you be affected by these changes, please contact our software services support team who will guide you through handling this in axis payroll. |

|

1.6 Class 1A NIC Liabilities on Terminations Awards and Sporting Testimonial Payments |

|

|

Class 1A NIC liabilities on termination awards and sporting testimonial payments come into effect on 6th April 2020. For termination awards, this introduces a new Class 1A NICs liability on non-contractual "cash" (or cash equivalent) taxable termination awards over a £30,000 threshold, which have not already incurred a Class 1 NICs liability as earnings. These need to be declared via RTI. axis payroll payment components can be flagged accordingly, allowing this to be processed through your payroll and submitted in your RTI submissions. A factsheet from HM TReasury is available at https://www.gov.uk/government/publications/national-insurance-termination-awards-and-sporting-testimonials-bill-factsheet |

|

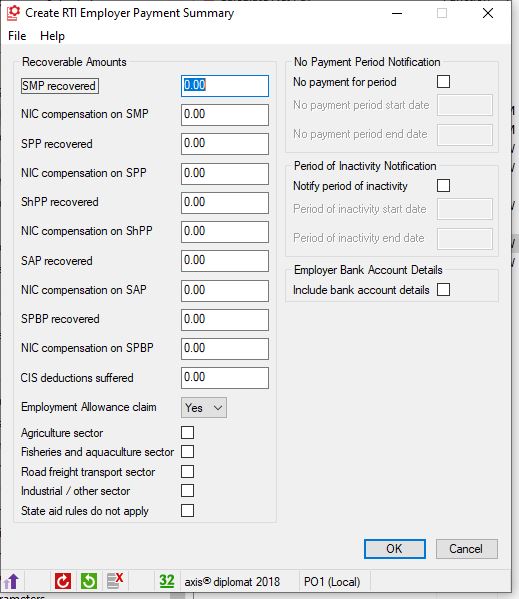

2. Employment Allowance 2020-2021

If you are an eligible employer, the employment allowance is increasing to £4,000 a year from April 2020. If you aready claim the allowance and will continue to claim you will need to ensure that you submit an Employer Payment Submission (EPS) in the new tax year and then continue to make the appropriate deductions from the amount of Class1 secondary National Insurance Contributions that you would have paid to HMRC.

If you have been eligible to claim the 'Employment Allowance' and have not yet submitted your claim for 2019-2020, you will need to go to 'Amend Employer Details' for the payroll data set through which you wish to claim the allowance and tick the 'Employment Allowance' option. Note: if you are operating more than one payroll data set, you should only claim through one data set.

Your final Calculate Monthly Remittance for the year will then include your claim for the allowance. You will then need to set 'Employment Allowance claim' to 'Yes' when submitting your final end of year EPS to advise HMRC that you are making the claim.

3. Information for axis payroll 2016 users

The information contained in this Payroll User Guide Supplement applies to axis payroll 2016 and axis payroll 2018 users.

4. Preparation

4.1 When Do I Install the Update?

You do not need to install this update until you have completed the final period of the year, however it is safe to install the update at any time.

4.2 Dates Of Birth

In order to allocate employees to the correct NI category, you must ensure that you hold the correct date of birth against each active employee record.

4.3 Employee Addresses

In order for HMRC to apply Scottish Rate of Income Tax and Welsh Rate of Income Tax correctly, it is important that employee addresses are kept up to date.

4.4 Employer Bulletin

You are advised to read the Employer Bulletin: Budget 2020 and the Employer Bulletin February 2020 which are available for download from the GOV.UK website.

4.5 Year End Stationery

As this update introduces the ability, to print P60's onto plain paper you are not required to order year end P60 stationery from HMRC.

If you still wish to use the pre-printed stationery, supplies are available free of charge from HM Revenue & Customs - please refer to the Employer Orderline

The available P60 stationery format is:

- P60 (Single Sheet) - for Inkjet or Laser printers

NOTE. Since new copies of the stationery are issued every tax year, you should only order sufficient quantities to cover this year.

4.6 P45 Stationery

P45 forms for leavers are unchanged.

Supplies are available free of charge from HM Revenue & Customs Employer Orderline

The supported formats is:

- P45 (Laser Sheet)

4.7 Week 53 / Week 1

The 2019 / 2020 tax year includes a Week 53 for weekly payrolls with a Saturday or Sunday Pay Date, i.e. Saturday 4th April or Sunday 5th April 2020.

Twoweekly and Fourweekly payrolls will have a Period 27 (Week 54) / Period 14 (Week 56) if the Pay Date falls on Saturday 4th April or Sunday 5th April 2020.

5. Receiving and Installing the Update

5.1 Where Do I Install The Update?

The update must be installed on your axis payroll software server. This will usually be your network server, but a number of axis payroll users run their payrolls on a stand-alone PC.

5.2 Downloading the axis payroll software update

If you have the axis diplomat accounts package installed on the same server as your payroll, you can schedule a full axis diplomat software update from within axis diplomat for automatic overnight installation. Instructions on scheduling a software update can be found at Scheduling an axis diplomat software update

Alternatively, customers will manually download the update from our website as in previous years.

To manually download the update:

- Ensure you are logged on to your payroll server as an administrator.

- Ensure you are logged into your account at www.axisfirst.co.uk.

- Your software update can be downloaded from https://www.axisfirst.co.uk/payrollMarch2020/ then selecting the appropriate download. Ensure that you read the terms and conditions fully before proceeding; an option is provided to print these if required. This area provides full instructions on installing software updates.

5.3 Installing the Update

Follow the Installation Procedure detailed below.

Please note that you need only install this update once for all axis payrolls providing that all payrolls reside on the same machine. Where payrolls are 'switched' between 'home' and 'office', then each such machine requires the update.

5.3.1 Copy Data to Full Backup

Ensure that a full backup of the system is taken. Use the 'Copy Data to Full Backup' function to create an archive backup of the payroll data on to removable media. We also strongly recommend that a full backup of the axis programs and data is made.

5.3.2 Installing the Update

You should run the installation procedure from the axis payroll server.

- You should be logged onto the axis payroll server. Elevation will be required.

- Ensure that all axis users are out of the system. You can do this by clicking on the System Console/User Status Enquiry button, found on the axis payroll Scheduler toolbar. Then come out of the system yourself

- If installing a downloaded version of the software, the file needs to be on the axis server and so may need to be copied to the server either directly over the network or via a form of removable media if it has been downloaded on another workstation. The executable can then be run to install the update files.

- If installing from removable media, insert the update device into the server. The device should auto-run. If it does not, please call for assistance

- Click on Install/Upgrade axis diplomat (2016 or 2018) System.

- Click Upgrade Existing System.

- If you are continuing to use axis payroll 2016, an information screen will appear:

Confirm that you wish to continue- Confirm that you accept the terms of the license agreement:

- Select the drive that contains your axis payroll system. This will normally be the default drive presented:

- The installation procedure will now check that there are still no users in the system, check for sufficient disk space and then ask you to confirm that you wish to update the axis diplomat Software.

- The installation procedure will continue and update the axis payroll software.

- Once the installation has completed, you will receive a ‘Setup Completed Successfully’ message, click ‘OK’ and then ‘Cancel’ out of the menus.

- Finally, whilst you are still logged on to the axis server, you should enter each of your axis payroll systems in turn and perform any updates requested.

- This completes the installation procedure. Once the installation has completed, you will receive a ‘Setup Completed Successfully’ message, click ‘OK’ and then ‘Cancel’ out of the menus.

6. Year End Procedures

Ensure that you have installed your axis payroll Legislation Update before proceeding with the year end procedures. Please ensure that a FULL security backup is taken of the payroll data BEFORE installing the axis payroll Legislation Update and again before running the last function ‘Year End Processing’.

You also need to ensure that you have:

- Run your final period end

- Run 'Calculate Monthly Remittance'

- Checked that your last submitted FPS is correct.

- Created and successfully submitted your final 'RTI Employer Payment Summary' (EPS) if this is your only payroll frequency and payroll data set or is the payroll frequency/payroll data set from which you have chosen to submit combined figures. You will need to submit a final year end EPS even if you have no statutory payments to recover in order to advise HMRC that you are making the final submission for the year.

Please note: HMRC accept the 'final submission for the year flag' in either the last submitted FPS file for the year or in the final EPS file. axis payroll only supports submission of this flag in the EPS and the file is automatically flagged in the background as the final submission for the year. The 'end of year questions and declaration' are also no longer required and so have been removed from the summary. Refer to http://www.gov.uk/payroll-annual-reporting/send-your-final-payroll-report for further information.

6.1 Reports to Run

6.1.1 Print Pay Component Year End Totals

The system will produce a 132 column plain paper report detailing the total amounts accumulated for each pay/deduction component, total PAYE and total NIC. Please read the associated help documentation for further details.

6.1.2 N.I.C. Year to Date Report

The system will produce a 132 column plain paper report (based on the NIC section of a P11) detailing N.I. Liable Earnings and N.I. Contributions for each employee on a period by period basis for the frequency selected.

We would advise that the report is kept for a minimum of 3 years, in case of query from HM Revenue & Customs.

Please read the associated help documentation for further details.

6.1.3 P.A.Y.E. Tax Year to Date Report

The system will produce a 132 column plain paper report (based on the PAYE section of a P11) detailing Taxable Earnings and Tax Paid for each employee on a period by period basis for the frequency selected.

We would advise that the report is kept for a minimum of 3 years, in case of query from HM Revenue & Customs.

Please read the associated help documentation for further details.

6.1.4 Year End Employee Absence Report

The system will produce a 132 column plain paper report with one page per employee showing each day of sickness absence, maternity leave, etc, taken during the year. Both April 2019 and April 2020 are printed for information.

Please read the associated help documentation for further details.

6.1.5 Year End Payment Summary Report

The system will produce an 80 column employee listing of NIC and tax deductions followed by a summary of payments for the year.

We would advise that a copy of the report is kept on file for a minimum of 3 years in case of query from HM Revenue & Customs.

Please read the associated help documentation for further details.

6.2 P60 Print

A P60 must be generated and given to each employee still employed on 5th April.

Please refer to the Introduction of this supplement for further information on how to order stationery and which formats are available.

The documents are printed in surname order.

Please read the associated help documentation for further details.

6.3 End of Year Returns

You must ensure that you have successfully submitted an RTI Employer Payment Submission file if this is your only payroll frequency and payroll data set for the employer PAYE reference or is the payroll frequency/payroll data set from which you have chosen to submit combined figures before proceeding to use the Year End Processing function. You will need to submit a final year end EPS even if you have no statutory payments to recover in order to advise HMRC that you are making the final submission for the year.

Please note: HMRC accept the 'final submission for the year flag' in either the last submitted FPS file for the year or in the final EPS file. axis payroll only supports submission of this flag in the EPS and the file is automatically flagged in the background as the final submission for the year. Refer to http://www.gov.uk/payroll-annual-reporting/send-your-final-payroll-report for further information.

7. Year End Processing

7.1 Security Back Up

You should now take a Year End Security Copy of all axis payroll Data using the 'Copy Data to Full Backup' function and selecting the 'Retain backup indefinitely' and 'Archive backup' options.

We would advise you to keep the backup archive for a minimum of 3 years in case of query from HM Revenue & Customs.

This is also important in case there is a problem with your end of year returns.

7.2 Year End Processing

This function needs to be run for each payroll frequency.

The system asks for confirmation that you have read and understood this guide before proceeding and that a security back up has been taken.

The process then clears all accumulators to zero for the new tax year.

The previous years’ details are retained in the Payroll Payment Archive File.

The Employment Allowance tick box located in Amend Employer Details is automatically cleared if your Employers National Insurance for tax year 2019/2020 exceeds £100,000.

Re-enter your payroll system.

8. The New Year

8.1 Employment Allowance

The Employment Allowance increases to £4,000 per year from 6th April 2020.

Even if you were eligible for, and claimed, Employment Allowance for the tax year ending 5th April 2020, you will need to submit a fresh claim.

If you have are newly eligible to claim the 'Employment Allowance' you will need to go to 'Amend Employer Details' for the payroll data set through which you wish to claim the allowance and tick the 'Employment Allowance' option. Note: if you are operating more than one payroll data set, you should only claim through one data set. Calculate Monthly Remittance will then include your claim for the allowance.

You will also need to create and submit an RTI Employer Payment Summary in the first month of the tax year to advise HMRC that you are claiming the allowance setting the 'Employment Allowance claim' option to 'Yes' and ticking the appropriate company sector option for your business (see https://www.gov.uk/guidance/changes-to-employment-allowance for further information).

8.2 Tax Code Changes

The standard personal allowance remains at £12,500. This applies to England and Northern Ireland, Scotland and Wales.

The code for emergency use with effect from 6th April 2020 also remains at 1250L

No uplifts are applicable to L, M and N suffix tax codes.

Where you receive a code notification for an individual employee to be operated from 6th April 2020 (on Form P9(T) or via your online HMRC account), the specified code must be entered after the year end has been run.

Refer to form P9X(2019) for further details.

8.3 Class 1 National Insurance Contributions

Calculate Net Pay will check the tax year / pay date and automatically apply the following Class 1 earnings thresholds effective from 6th April 2020:

| Weekly | Monthly | Yearly | |

| Lower Earnings Limit | £120.00 | £520.00 | £6,240.00 |

| Primary Threshold | £183.00 | £792.00 | £9,500.00 |

| Secondary Threshold | £169.00 | £732.00 | £8,788.00 |

| Upper Secondary Threshold (Under 21) (UST) | £962.00 | £4,167.00 | £50,000.00 |

| Apprentice Upper Secondary Threshold (Apprentice Under 25) (AUST) | £962.00 | £4,167.00 | £50,000.00 |

| Upper Earnings Limit | £962.00 | £4,167.00 | £50,000.00 |

The Employee and Employer Class 1 NI contribution rates for NIC categories A, B, C, H, J, M and Z remain unchanged.

Calculate Gross Pay will continue to check employees in the 'under 21' and 'under 25' N.I. categories and amend their category to a standard category if that employee has achieved the age of 21 or 25 by the pay date of the period being run.

Note: The 'Print Payroll Parameters' function, accessed from the 'Supervisor Functions' menu, may be used to produce a report of the rates applicable to each NI category and band of earnings.

8.4 Statutory Sick Pay

The weekly rate increases to £95.85.

The appropriate daily rate is determined by the number of qualifying days.

Eg. The daily rate for an employee with five qualifying days is £19.17.

8.5 Statutory Maternity / Paternity / Adoption / Shared Parental and Parental Bereavement Pay

Statutory Maternity Pay (SMP) and Statutory Adoption Pay (SAP) are paid at 90% of the employee's average weekly earnings for the first six weeks. The standard weekly rate for the remaining weeks is £151.20 or 90% of the employee's average weekly earnings, whichever is lower.

Statutory Paternity Pay (SPP) is payable for 1 or 2 weeks at the standard weekly rate of £151.20 or 90% of the employee's average weekly earnings, whichever is lower.

Statutory Shared Parental Pay (ShPP) and Statutory Parental Berevement Pay (SPBP) are payable at the standard weekly rate of £151.20 or 90% of the employee's average weekly earnings, whichever is lower.

The amount of SMP/SPP/ShPP/SAP/SPBP that may be recovered for employers who do not qualify for Small Employers Relief (SER) is 92% of the SMP/SPP/ShPP/SAP/SPBP paid to their employees.

Employers who do qualify for Small Employers Relief (SER) can recover 100% of the SMP/SPP/ShPP/SAP/SPBP paid to their employees plus NIC compensation of 3%.

A ‘small employer’ is one who paid (or was liable to pay) total gross class 1 NICs of £45,000 or less in the individuals qualifying tax year. For further information pkease refer to https://www.gov.uk/recover-statutory-payments

8.6 Student Loan and Postgraduate Loan Recovery

The annual employee earnings threshold for the collection of existing Plan 1 Student Loans increases from £18,935 to £19,390.

The annual employee earnings threshold for the collection of Plan 2 Student Loans increases from £25,725 to £26,575.

The deduction percentage rate for student loans remains unchanged at 9% of earnings above the threshold.

The annual employee earnings threshold for the collection of Postgraduate loans for 2020/2021 remains at £21,000 and deductions are made at 6%.

8.7 PAYE Income Tax

Calculate Net Pay will automatically apply the appropriate annual tax bands for the tax year / pay date as follows:

|

2019 - 2020 |

2020 - 2021 |

||

| England & Northern Ireland Basic Rate | 20% | £1 to £37,500 | £1 to £37,500 |

| England & Northern Ireland Higher Rate | 40% | £34,501 to £150,000 | £37,501 to £150,000 |

| England & Northern Ireland Additional Rate | 45% | £150,001 and above | £150,001 and above |

| Scottish Starter Rate - 6th April to 10th May | 19% | £1 to £2,049 | £1 to £2,049 |

| Scottish Basic Rate - 6th April to 10th May | 20% | £2,050 to £12,444 | £2,050 to £12,444 |

| Scottish Intermediate Rate - 6th April to 10th May | 21% | £12,445 to £30,930 | £12,445 to £30,930 |

| Scottish Higher Rate - 6th April to 10th May | 41% | £30,930 to £150,000 | £30,931 to £150,000 |

| Scottish Additional Rate - 6th April to 10th May | 46% | £150,001 and above | £150,001 and above |

| Scottish Starter Rate - 11th May onwards | 19% | £1 to £2,085 | |

| Scottish Basic Rate - 11th May onwards | 20% | £2,085 to £12,658 | |

| Scottish Intermediate Rate - 11th May onwards | 21% | £12,445 to £30,930 | |

| Scottish Higher Rate - 11th May onwards | 41% | £30,931 to £150,000 | |

| Scottish Additional Rate - 11th May onwards | 46% | £150,001 and above | |

| Welsh Basic Rate | 20% | £1 to £37,500 | £1 to £37,500 |

| Welsh Higher Rate | 40% | £37,501 to £150,000 | £37,501 to £150,000 |

| Welsh Additional Rate | 45% | £150,001 and above | £150,001 and above |

The new bands for 2020-21 are effective from the first pay day on or after 6th April 2019. Note that Scottish rates change 11th May 2020.

NB. A report of all the current statutory deduction and payment rates can be produced using the ‘Print Payroll Parameters’ function which is located on the Supervisor Functions menu.

8.8 Pension Scheme Qualifying Earnings

As the qualifying earnings are reviewed annually, please contact your pension scheme provider to see if there are any changes.

If so, this can be changed in Amend Pension Scheme Details.

By law, the total minimum amount of contributions which must be paid into workplace pension schemes increased on 6th April 2019. Employers must make a minimum contribution towards this amount and the staff member must make up the difference. If you decide to cover the total minimum contribution required, your staff won’t need to pay anything.

This table shows the minimum contributions you must pay and the dates when they increased:

| Date | Employer minimum contribution | Staff Contribution | Total minimum contribution |

| Until 5th April 2018 | 1% | 1% | 2% |

| 6th April 2018 to 5th April 2019 | 2% | 3% | 5% |

| 6th April 2019 onwards | 3% | 5% | 8% |

Please see https://www.axisfirst.co.uk/documentation/WorkPlace-Pensions/articles/14043 for detailed information on managing workplace pensions in axis payroll.The staff contribution rate may vary depending on the type of tax relief applied by your scheme. If you are unsure check your scheme documents.

8.9 Payrolling Company Car Benefits

If you are payrolling company car benefits, you will need to update the current car details for each employee to provide the 'Date first registered'.

If the vehicle fuel type is Hybrid, you will also need to complete the 'Zero emissions mileage value'.

These changes need to be made before your first payroll run of the new year.