axis diplomat 2020 Modules |

|||

17. Multiple VAT Registrations |

|||

|

|||

17.1 Overview |

|||

|

Manage VAT for businesses registered in multiple EC countries. With the increase in cross-border retail sales (sometimes referred to as Distance Sales), typically driven by successful eCommerce websites, many businesses now find that they must be registered for VAT in a number of European countries. Businesses selling goods to consumers in individual EC countries where the value of those sales exceed the VAT registration thresholds for those countries must be registered for VAT in those countries. This module provides the functionality to handle those multiple VAT registrations across multiple countries. |

|||

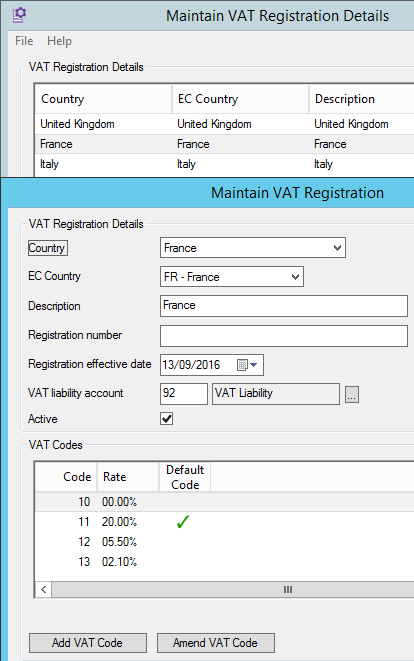

17.2 Record Details of Each VAT Registration |

|||

|

|||

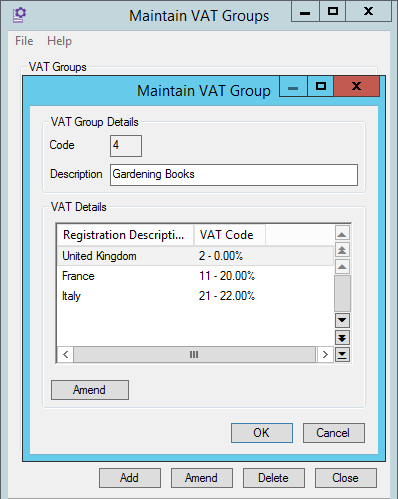

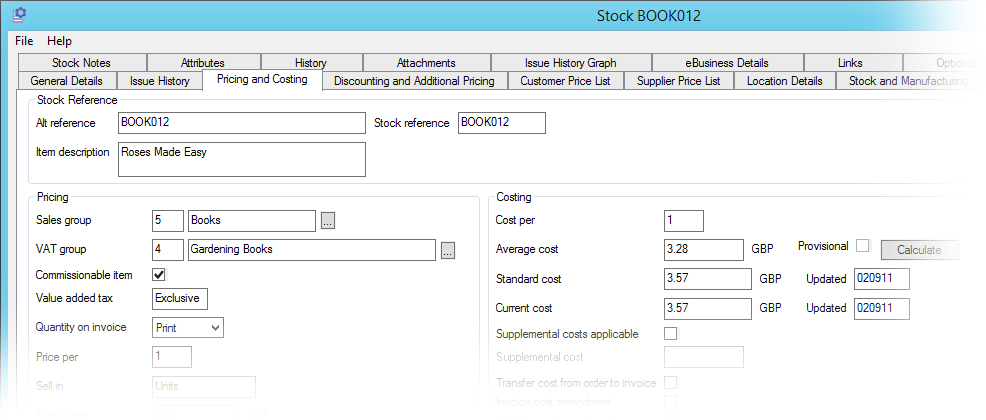

17.3 VAT Groups |

|||

|

|||